How is Farmland Evolving as an Institutional Asset?

By Steve Bruere & Ailie Elmore

Sponsored by Peoples Company

LR_Farmland_InstitutionalAsset-04

Farmland markets have evolved tremendously over time as investors have shifted their focus away from traditional stock and bond investing toward alternative asset classes like farmland which presents its own unique opportunities and challenges. According to a recently published study titled “The Evolution of Farmland as an Institutional Asset” a defining period for evaluating farmland as an institutional asset class occurred more than 15 years ago when investors found themselves suffering from tremendous losses in the stock market.

Previously, farmland was largely thought of as an asset class for farmers and ranchers, not institutional investors. However, as investors looked for ways to achieve the security of investing in treasuries while maintaining equity-like returns, farmland emerged as an institutional asset.

Some early investors began investing in agricultural real estate in the 1980s, but up until the Great Financial Crisis in 2008, it was largely dominated by producers and small private investors. The focus of this analysis, in the latest White Paper from Peoples Company, is to investigate the trends in farmland markets before and after the 2008 market crisis. This white paper discusses how institutional ownership of farmland evolved after this event as well as the drivers of this change and how we may be on the cusp of another age in farmland investing.

The Expansion of Farmland as an Institutional Asset

While equity and fixed-income markets suffered during 2008, farmland came away from the recession relatively unscathed. According to the USDA Land Values Summary, U.S. Farmland returned on average 9.2% during this period with the popular agricultural producing “I-States”, Iowa, Illinois, and Indiana returning 20.7%, 16.1%, and 15.3%, respectively, during this time. Some were concerned that the crash of the commercial and residential real estate sectors would eventually make its way to the agricultural sector, but high commodity prices supported farmland values while low interest rates benefited farmers’ balance sheets during this time.

Farmland as a Diversification Tool

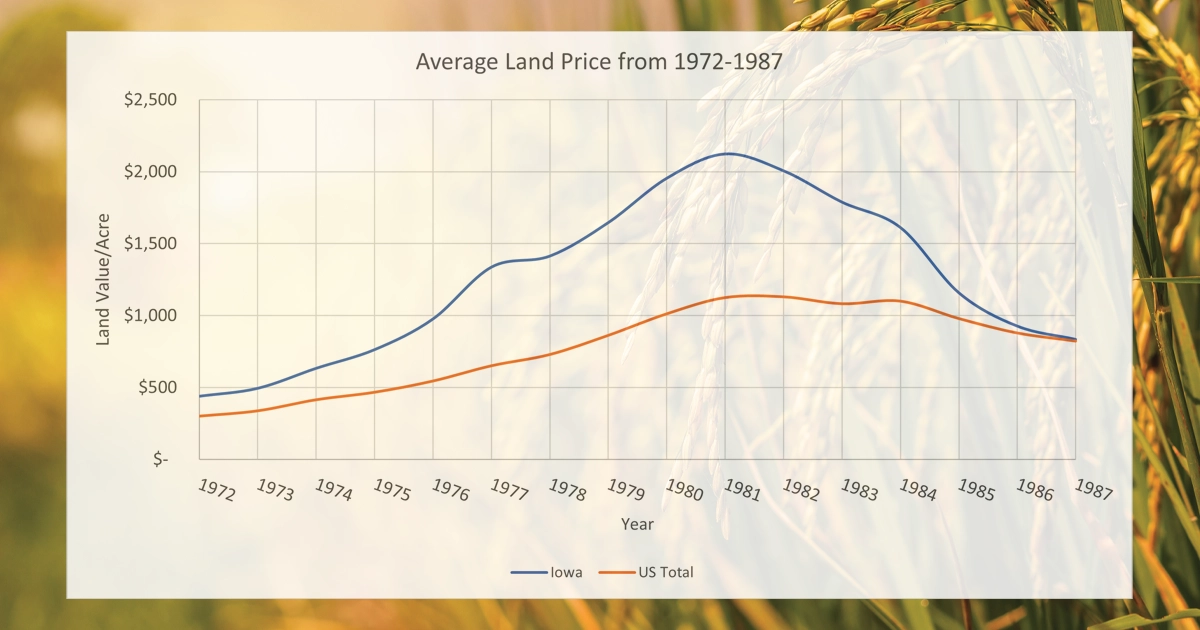

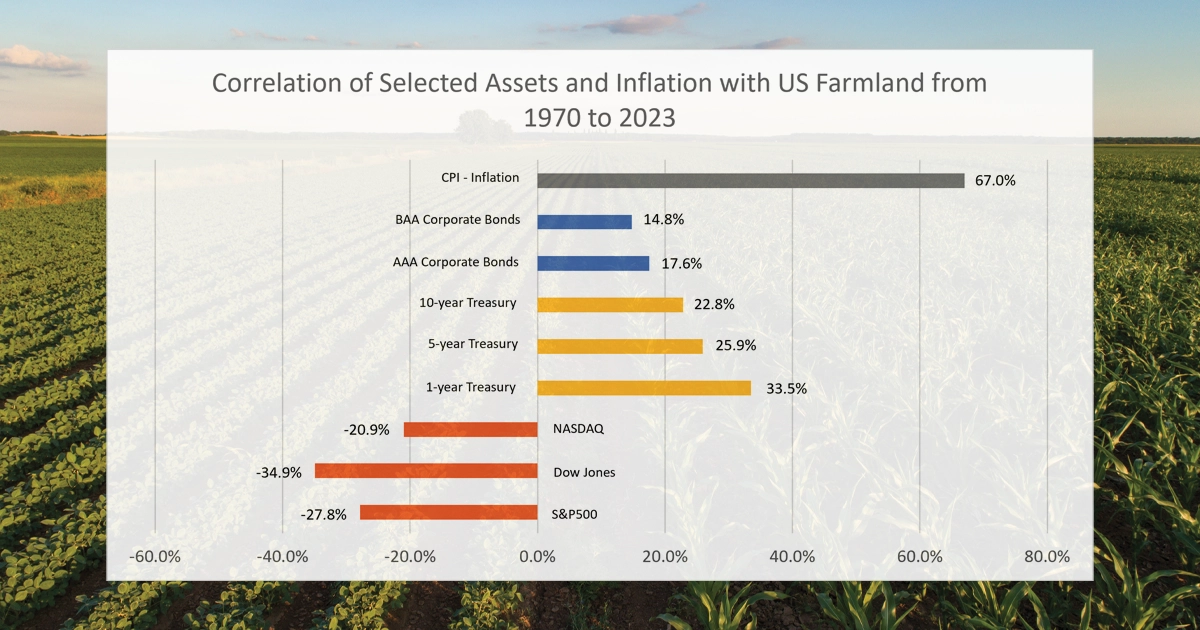

The Great Financial Crisis signaled to institutions that farmland could potentially be used as a diversification tool in combination with more traditional assets such as equity and fixed income. After expanding the scope to look at a historical perspective, farmland historically shows a negative correlation with equities suggesting what occurred in 2008 was not a one-off event. With careful examination of market patterns, there have been other points in history where equities demonstrated low or negative returns while farmland returned double-digit numbers.

There are many factors at work that can explain this relationship based on the period examined but there is one consistent factor always at place: regardless of what is happening in the world, people still need to eat, and farmland is quite literally the key ingredient to that. Investors took notice of farmland’s potential and started finding ways to capitalize on it in a variety of different ways.

Learn more about the evolution of farmland as an institutional asset in the free white paper from Peoples Company, available now.