Brad Kelley is Texas’s Largest Landowner in 2024

Brad Kelley is Texas’s Largest Landowner in 2024

By Eric O'Keefe

Photography By Laurence Parent

LR_BradKelley-BrewsterRanch-01

ONLY IN TEXAS. Kelley's 353,494-acre Brewster Ranch is listed for sale for $245 million with King Land & Water.

Texas’s largest landowner is a Tennessean named Brad Kelley. Currently, Kelley owns 940,000 acres in the Lone Star State. Over the last two decades, the total number of acres has fluctuated as Kelley has acquired — and sold off — numerous holdings. At various times, his portfolio has included ecologically significant tracts such as the 17,351-acre Powderhorn Ranch on Matagorda Bay. Unlike Texas’s other leading landowners, Kelley is more than willing to part with any or all of his holdings for the right price. He currently has more than a half-million acres listed for sale with James King of King Land & Water.

Brad Kelley the Antifragmentation Machine

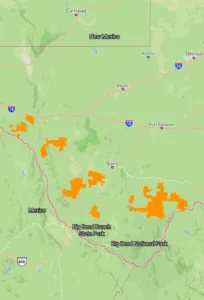

Nowhere is Kelley’s methodology more visible than in the Big Bend region of Far West Texas, where Kelley has been buying and selling ranches since the early 2000s. In 2024, Kelley sold the 19,814-acre Tesnus Ranch, which King had listed for $15 million, and the 34,480-acre YE Mesa Ranch, which King had listed for $23 million.

King refers to Kelley as “the antifragmentation machine.” In layman’s terms, Kelley is reconfiguring his ownership in exactly the opposite direction of current market trends. “All the data from the Texas Real Estate Research Center shows how land in Texas is getting carved up into smaller and smaller tracts that sell for higher prices per acre,” King says. “Brad is doing just the opposite. He’s buying historic ranches that have been divvied up or parceled off and aggregating them into much larger properties.”

Brad Kelley the Entrepreneur

Kelley made his first fortune with Commonwealth Brands, a discount cigarette maker he founded in Bowling Green, Kentucky. Commonwealth’s strategy was simple and straightforward. Unlike other tobacco companies, Commonwealth did no advertising or marketing. What it ultimately did was acquire Brown and Williamson’s assets from American Tobacco at a fire sale price of $35 million. According to Houchen Industries, those assets were worth many times $35 million, specifically, in excess of $400 million. Houchen should know. In 2001, the company paid Kelley an estimated $1 billion for Commonwealth Brands. Houchen then grew Commonwealth into the nation’s fourth largest cigarette manufacturer and flipped it to Imperial Tobacco Group for $1.9 billion in 2007.

On a side note, Kelley also brews his own whiskey — and bourbon and tequila and vodka and rum. The Kentucky native has a marked affinity for racehorses. In 2012, he acquired one of Thoroughbred racing’s most renowned stables, Calumet Farm. The following year, a Calumet Farm runner named Oxbow won the Preakness.