Guaranteed Loan Programs Find Favor

Guaranteed Loan Programs Find Favor

investing22016_fi

Ag lenders are reducing exposure to lending risks by requiring more farm real estate as collateral for large, non-real estate farm loans. –The Editors

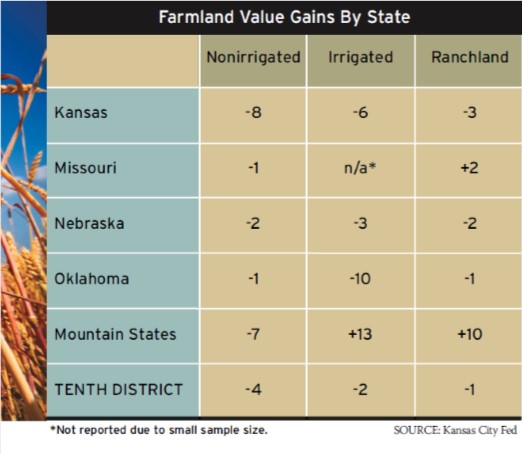

Using responses from 213 banks, economists with the Kansas City Federal Reserve Bank presented a survey of Agricultural Credit Conditions covering the first quarter of 2016. A selection of observations by some of these bankers follows:

“Good quality land has still brought a premium at auctions. Marginal soil types have reduced in price or ‘no sold’ at auctions. Cash rents have remained steady.” – Southeast Nebraska

“Leveraged farmers are beginning to see their debt load increase and becoming harder to manage.” – Southeast Colorado

“Production expenses have not decreased in proportion to decreased market prices.” – Southeast Colorado

“Debt repayment on real estate and equipment loans is a big problem.” – Western Missouri

“Cow-calf areas have plenty of margin after annual debt service and living costs.” – Southeast Wyoming

Read the complete report at www.KansasCityFed.org.